2023 has come to an end and the annual housing numbers have been tallied. As you know, I give an overview of the market stats each month…but at the end of the year I like to take a deeper dive. The following report pertains to residential real estate sales in the City of Oshkosh and Town of Algoma for 2023 vs 2022.

2023 Statistics:

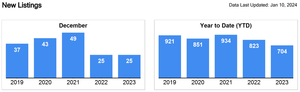

- The number of new homes listed for sale decreased by almost 15% compared to last year. This comes as no surprise. We had fewer homes listed in almost every month of 2023 compared to 2022. TAKEAWAY: Multiple factors led to fewer homes hitting the market. Higher interest rates are keeping homeowners in their current homes because they don’t want to trade their low rate for a higher rate when they have to buy again. Higher prices have also been a double-edged sword. While a homeowner will likely make a fair amount of money when selling their home…they will also have to pay more for the next home.

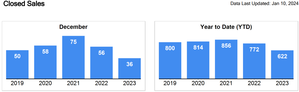

- The number of homes sold decreased by almost 20%. This is another trend we saw the entire year. Fewer homes listed for sale, thus fewer homes ultimately selling. TAKEAWAY: An interesting point here is the difference between listed homes and sold homes. -15% in listings but –20% in sales. Shouldn’t that number be almost the same? These numbers are generally closely matched but the number of listings is a leading indicator, and the number of sales is a trailing indicator. Meaning, if the number of new listings is declining, it generally takes a couple months for that to show up in the number of sales. Additionally, and probably more importantly, is that more deals were canceled this year than we’ve seen in quite some time. Buyers are getting cold feet. Financing not approved due to interest rates, cash needed, job status, etc. Appraisals coming in low. And a variety of other factors have resulted in some homes accepting offers, but not making it to the closing table.

- The median sales price has increased over 13% to $210,000. This is a remarkable increase on its own. But that’s a 13% gain over 2022 and 2022 was a 12% gain over 2021. Home values in Oshkosh have risen 25% in the past 2 years! TAKEAWAY: The obvious takeaway is that homeowners are gaining equity rapidly. And that potential homebuyers are having to pay more and more for the same house. The next question is, how is this sustainable? While I don’t believe we can continue at this rate of appreciation, we still have a supply shortage. And most homes are selling in the first week (often with multiple offers). Until the supply increases or demand decreases, I just don’t see how prices will fall.

- The list price compared to sales price is 101%. Meaning that homes are selling for 1% over asking price on average. This is down 1% compared to 102% in 2022. TAKEAWAY: What’s interesting here is that homes are still selling for more than the list price. BUT, not quite as much more as they were in 2022. This makes sense. Although it is still very much a seller’s market, we have not seen as many bidding war/multiple offer situations as we saw in 2022 (or 2021). There is also the fact that everyone knows it’s a seller’s market…and most homeowners want to try to list their home as high as possible. So some sellers are reaching higher than they might have in other markets. If the home is initially listed at 5-10% over the comparable sales, it stands to reason that they might not get much MORE than their asking price (because the asking price was already inflated).

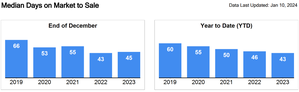

- The median days on market was down a few days to 43 days in 2023. This means that from the day a home is listed for sale until it closes takes approximately 43 days. TAKEAWAY: There is a common misconception that this number represents how long it takes to receive and accept an offer. That is not the case. An average escrow period is 35-40 days. This is the time needed for inspections, appraisals, lender underwriting and processing, etc. If you subtract this ~40 days, we find that homes have been accepting an offer within the first week on average.

Historical Reference:

- The number of new listings jumped back and forth between the low 800’s and low 900’s the past 4 years. In 2023, 704 new listings was a sharp decline compared to recent years.

- The number of closed sales rose from 2019 to 2021. In 2022 it fell, and again in 2023. 234 less homes sold in 2023 than in 2021.

- Both list price and sales price have increased in each of the past 5 years. The median price of an Oshkosh home in 2019 was $135,000. In 2023 that has increased to $210,000.

- The median days on market has dropped each of the past 5 years. From 60 days in 2019 to only 43 days in 2023.

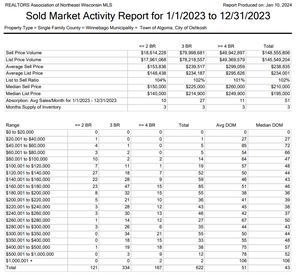

- I won’t give a full analysis of this report. But if you care to dig into more details, here you can see the breakdown of the homes sold by both price range and # of bedrooms.

Mortgage Interest Rates:

- The big headline in 2023 was the mortgage interest rates. That factor has had the largest impact on housing numbers this past year. Although rates began climbing in 2022, it wasn’t until this year that the effects were truly felt. Per Freddie Mac, the average 30-year fixed rate mortgage on 1/1/2023 was 6.48%. On 12/31/2023 that was 6.61%. BUT, throughout the year the rates were rising. Up to a high of 7.79% in the 3rd quarter. It’s only been in the past 4-6 weeks that rates started coming back down to the levels we saw at the beginning of 2023. That higher rate seems to have been enough to prevent some homeowners from selling because they don’t want to lose their current rate (many who purchased or refinanced between 2020-2021 have fixed rates under 3.0%)

- If interest rates were the biggest story of 2023…then it’s fair to ask “what are rates projected to do in 2024?”. As of early January 2024, most Federal Committee officials expect the Federal Reserve Rate to be cut 3 times in 2024. And while the FED rate is not the same as a mortgage interest rate, they do generally move together. Most analysts are projecting mortgage interest rates to drop between 0.5% and 1.0% this year.

Predictions:

Looking at the primary metrics I track in housing; new listings, closings, price, and days on market, here are my predictions for 2024:

- The number of new listings will rise compared to 2023. I don’t think it will be a drastic increase, but it might get back to 2022 levels.

- Similar sentiments with the number of closed homes. I do believe the number of closed transactions will rise back to levels close to what we had in 2022.

- Median sales price is still trending upwards. I do not believe we will see double-digit appreciation like we’ve had the past 2 years, but I think the average home in Oshkosh will cost more next year than it does today. Somewhere in the 3%-7% range for appreciation.

- Days on market to sell will hold. This number has been trending downward for the past few years but just based on how long it takes for a lender to process a transaction, appraisals and inspections to be performed, etc. that number really can’t go down much further. Homes should continue to sell in the first week or two on the market (assuming they’re priced reasonably and properly maintained).

A couple additional thoughts regarding 2024:

- Early in January 2024 we seem to have an increase in new listings, and buyer activity. The first 2 weeks of the year have seen as many new homes listed as we saw in the entire month of December. With the positive outlook on interest rates, I feel that it will be a busy spring housing market.

- It’s also a presidential election year. Typically, that means that the second half of the year will have uncertainty, and with uncertainty comes hesitation and caution for many. Some buyers and sellers will choose to wait until after the election to make a move. We often see a slowdown in sales and activity as we approach an election cycle. And I would expect to see that happen again later this year. BUT, I would also expect things to rebound quickly after the election. Regardless of what party emerges, home sales and prices typically tick back up in the months following an election.

Recommendations:

As for my suggestions/recommendations to everyone reading this…it’s the same as always. If it makes sense for you and your family to make a move or buy a new property, then do it. If you are relocating, having kids, kids moving out, changing jobs, etc. then it generally makes sense to make that move. And it doesn’t really matter what the rest of the “market” is doing. Conversely, if you don’t have a pressing need to buy or make a move, then the “market” shouldn’t be a driver to force you to make a change either.

Here’s to a great 2024 for all my Oshkosh neighbors!

-Kevin-